Revenue

Last updated: May 23, 2025

What is Revenue?

Revenue is the total income generated from a company's primary business operations before deducting any costs or expenses. Often called the "top line" because it appears at the top of the income statement, revenue represents the gross amount earned from core business activities such as product sales, service fees, subscriptions, or licensing agreements.

Revenue Formula

How to calculate Revenue

Revenue calculation depends on your business model and revenue recognition method. For a subscription business, if a customer signs an annual contract for $12,000 with monthly payments, you would recognize $1,000 in revenue each month over the 12-month period, totalling $12,000 for the year. For one-time sales, revenue equals the sale price multiplied by units sold. It's crucial to distinguish between cash received and revenue recognized - they may not occur in the same period depending on your accounting method.

Explore Revenue sample data

This visualization is a live embed from Klipfolio PowerMetrics.

Start tracking your Revenue data

Use PowerMetrics, modern analytics platform, to monitor your data. Choose a service below to start tracking your Revenue instantly.

Revenue benchmarks

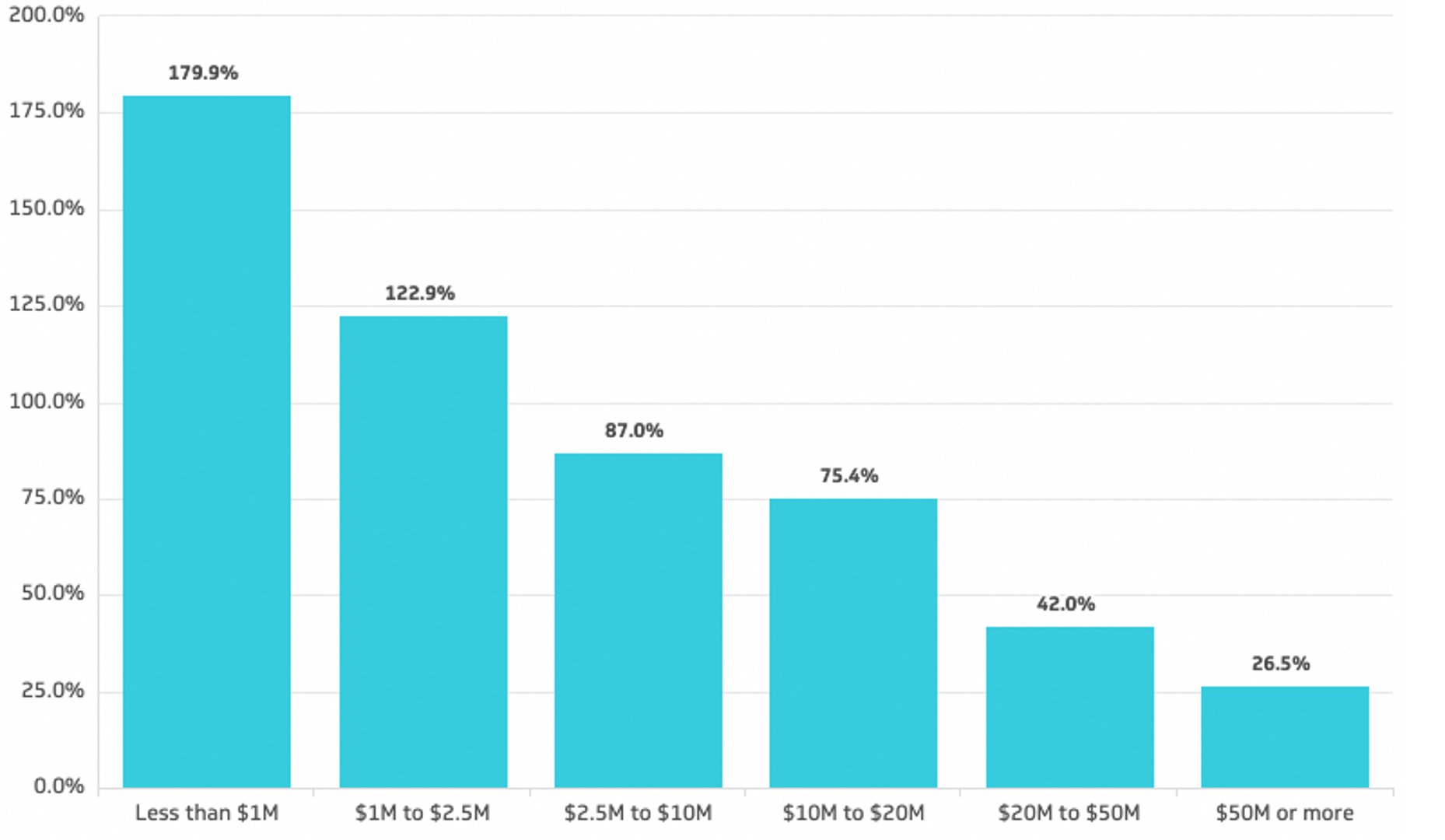

Annual Revenue Growth Rate by ARR

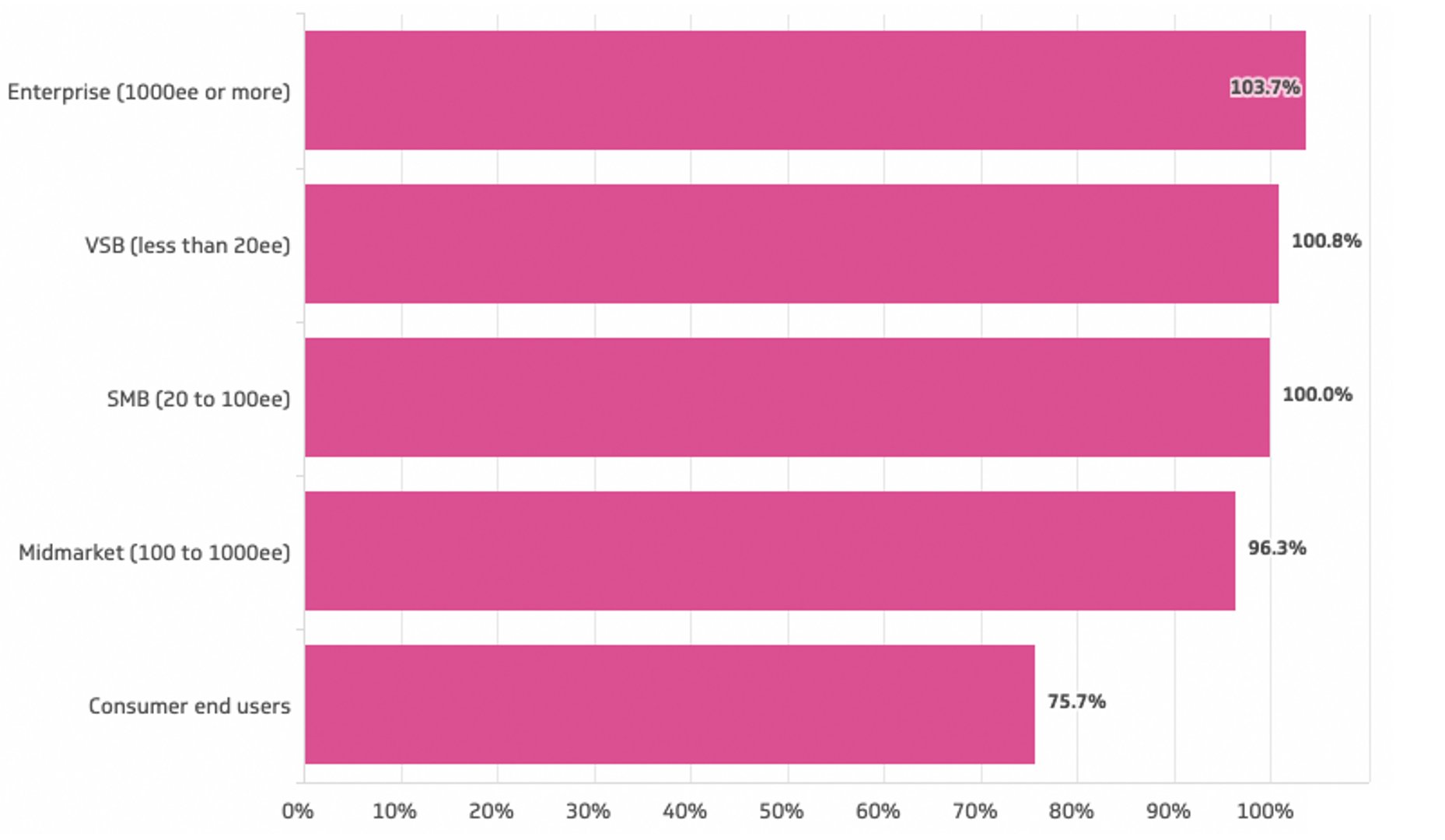

Annual Revenue Growth Rate by Target Customer

How to visualize Revenue?

Revenue visualization should match your analysis needs. Use summary charts or KPI dashboards to display current revenue figures and compare them to targets or previous periods. Time-series line charts effectively show revenue trends and seasonality patterns, while area charts can illustrate cumulative revenue growth. For businesses with multiple revenue streams, stacked bar charts or waterfall charts help break down contributions by product line, geography, or customer segment.

Revenue visualization example

Summary Chart

Revenue

Chart

Measuring RevenueMore about Revenue

Revenue encompasses all income from primary operations including product sales, service fees, subscription revenue, licensing income, and rental income, but excludes non-operating income like investment gains or asset sales. Understanding revenue recognition principles is critical - companies using accrual accounting recognize revenue when earned (regardless of payment timing), while cash-basis companies recognize it when payment is received.

Key revenue-related metrics include Monthly Recurring Revenue (MRR), Annual Recurring Revenue (ARR), Average Revenue Per User (ARPU), and revenue growth rates. Analysts should also track revenue quality by examining customer concentration risk, recurring versus one-time revenue mix, and revenue predictability.

Revenue serves as the foundation for calculating gross profit (revenue minus cost of goods sold) and is essential for ratio analysis including gross margin, operating margin, and revenue multiples used in valuation. When analyzing revenue, consider seasonality patterns, contract terms, customer retention rates, and the sustainability of growth rates to provide meaningful insights for business decision-making.

Revenue Frequently Asked Questions

What's the difference between bookings, revenue, and cash, and why don't they match up on our reports?

These three metrics represent different stages of the customer value lifecycle. Bookings capture the total contract value when a deal is signed, representing a future commitment. Revenue is recognized when you've delivered the product or service, following accounting principles (ASC 606 or IFRS 15) that may spread recognition over time. Cash is collected when the customer actually pays, which might be upfront, in installments, or after delivery. The gaps between these metrics reveal important business dynamics: a growing gap between bookings and revenue suggests accelerating growth, while a widening gap between revenue and cash could indicate collection challenges or changing payment terms. Monitoring all three metrics provides a more complete picture of business momentum than any single number.

Should we focus more on total revenue or recurring revenue?

While total revenue drives immediate financial performance, recurring revenue (subscription, maintenance, etc.) usually creates significantly more long-term value, especially for growing companies. Recurring revenue provides predictability, reduces acquisition costs through retention, and typically commands higher valuation multiples (often 5-10x higher than one-time revenue). The ideal approach is tracking both, but emphasizing recurring revenue growth and retention metrics in strategic planning. A useful analysis is calculating your "recurring revenue base" at the start of each period—this represents revenue you'll generate without additional sales effort if retention remains stable, essentially your "guaranteed" baseline before new business.

How can we identify the most promising revenue growth opportunities in our data?

The most valuable insights typically come from segmentation analysis across multiple dimensions. Break down revenue by customer segment, product line, geography, acquisition channel, and customer tenure to identify pockets of outperformance. Look for segments with both strong growth rates and expanding gross margins, as these represent your most profitable growth vectors. Cohort analysis is particularly revealing—tracking how revenue from customers acquired in the same period evolves over time can uncover whether your customer success and expansion strategies are improving. Finally, examine revenue concentration: segments contributing more than 20% of revenue deserve deeper analysis for both growth opportunities and concentration risks.